Payment as a Service Market: Transforming the Way We Transact

Introduction:

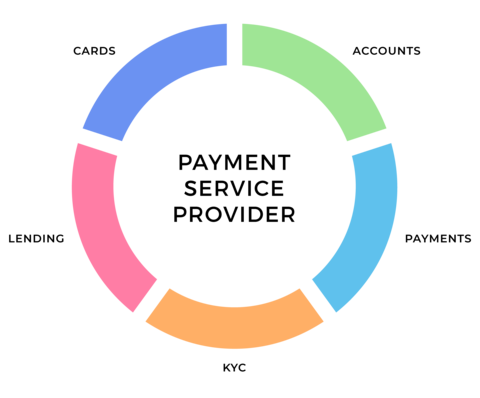

The landscape of payment services has undergone a significant transformation with the emergence of Payment as a Service (PaaS). PaaS enables businesses to streamline their payment processes by outsourcing them to third-party providers, eliminating the need for complex infrastructure and reducing operational costs. This article provides an overview of the Payment as a Service market, including its growth, key market segments, prominent companies, market drivers, regional insights, and the latest industry news.

Market Overview:

The Payment as a Service market industry is projected to grow from USD 11.29 Billion in 2023 to USD 65.53 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 24.10% during the forecast period (2023 – 2032). The market’s growth can be attributed to the increasing adoption of digital payment solutions, rising e-commerce transactions, and the need for secure and convenient payment processes.

Get Free Sample PDF Brochure –

https://www.marketresearchfuture.com/sample_request/8020

Key Market Segments:

The PaaS market can be segmented based on service type, deployment model, organization size, and end-use industry.

-

Service Type:

- Payment Gateway Services: Allow businesses to securely process online payments, enabling seamless transactions.

- Payment Processing Services: Handle the entire payment lifecycle, including authorization, settlement, and reconciliation.

- Payment Fraud Management Services: Provide advanced fraud detection and prevention solutions to mitigate payment risks.

- Others: Include services like subscription billing, recurring payments, and point-of-sale (POS) solutions.

-

Deployment Model:

- Cloud-based: Offered as a software-as-a-service (SaaS) solution, providing flexibility, scalability, and cost-effectiveness.

- On-premises: Installed and managed within an organization’s infrastructure, offering greater control and customization.

-

Organization Size:

- Small and Medium Enterprises (SMEs): Embrace PaaS to access affordable and scalable payment solutions, enabling them to compete with larger players.

- Large Enterprises: Utilize PaaS to optimize payment processes, enhance customer experience, and improve operational efficiency.

-

End-use Industry:

- Retail and E-commerce: Facilitate secure online transactions, improve checkout experiences, and enable global payment acceptance.

- BFSI (Banking, Financial Services, and Insurance): Offer secure payment solutions, fraud prevention, and compliance with industry regulations.

- Healthcare: Enable seamless payment processes for medical services, insurance claims, and patient billing.

- Travel and Hospitality: Provide convenient payment options for hotel bookings, flight tickets, and other travel-related services.

- Others: Include industries like telecommunications, transportation, education, and government, adopting PaaS for efficient payment management.

Key Companies:

The PaaS market is highly competitive, with several key players dominating the industry. Some prominent companies offering Payment as a Service solutions include:

- PayPal Holdings, Inc.

- Stripe Inc.

- Adyen N.V.

- Square, Inc.

- Fiserv, Inc.

- Wirecard AG

- Mastercard Incorporated

- Visa Inc.

- Worldpay, Inc.

- Global Payments Inc.

Market Drivers:

Several factors are driving the growth of the PaaS market:

-

Simplified Payment Processes: PaaS providers offer ready-to-use payment solutions, eliminating the need for businesses to build and maintain complex payment infrastructures.

-

Enhanced Security and Compliance: PaaS providers implement robust security measures, including encryption and tokenization, to protect sensitive payment data. They also ensure compliance with industry regulations, such as PCI DSS.

-

Rising E-commerce Transactions: The exponential growth of e-commerce has increased the demand for secure and seamless payment solutions, driving the adoption of PaaS.

-

Mobile Payment Adoption: With the proliferation of smartphones and mobile payment apps, businesses are turning to PaaS to enable mobile payment acceptance and enhance the customer experience.

Regional Insights:

The PaaS market exhibits significant growth across various regions:

-

North America: Dominates the market due to the presence of key PaaS providers and the high adoption of digital payment solutions in the United States and Canada.

-

Europe: Shows substantial growth, driven by the increasing demand for contactless payments, government initiatives promoting digital payments, and open banking regulations.

-

Asia Pacific: Witnessing rapid growth due to the rising penetration of smartphones, increasing e-commerce transactions, and digital payment innovations in countries like China, India, and Southeast Asian nations.

-

Latin America: Experiencing a growing demand for PaaS solutions, driven by the increasing adoption of digital payments and the expansion of e-commerce platforms.

-

Middle East and Africa: Embracing PaaS to enhance financial inclusion, enable secure cross-border payments, and drive economic growth.

Buy Now Premium Research Report – Get Comprehensive Market Insights.

Industry Latest News:

The PaaS market is characterized by constant innovation and collaborations. Some recent industry news includes:

-

PayPal launched a new service enabling users to buy, hold, and sell cryptocurrencies within its platform, expanding its offerings beyond traditional payment services.

-

Stripe partnered with a major e-commerce platform to provide integrated payment solutions, allowing businesses to seamlessly accept payments and manage orders.

-

Adyen announced its collaboration with a global ride-hailing platform, enabling secure and seamless payments for millions of users worldwide.

-

Square introduced new features in its payment ecosystem, including contactless payment options and enhanced fraud prevention tools.

Conclusion:

The Payment as a Service market is witnessing significant growth, enabling businesses to streamline their payment processes and improve customer experiences. With key market segments, prominent companies, market drivers, regional insights, and the latest industry news, the future of PaaS looks promising. As digital payments continue to gain traction and businesses seek convenient, secure, and scalable payment solutions, the demand for PaaS is expected to soar. The transformative power of PaaS has the potential to reshape the payment landscape, driving innovation and enhancing financial inclusion in the digital era.

** Also Check Trending Report of MRFR **

Europe IT Services Market –

https://www.marketresearchfuture.com/reports/europe-it-services-market-13895

US IoT Security Market –

https://www.marketresearchfuture.com/reports/us-iot-security-market-one-13897

Taiwan Advanced Connectivity in E-Commerce & Retail Market –

https://www.marketresearchfuture.com/reports/taiwan-advanced-connectivity-in-ecommerce-retail-market-12665

India OTT Market –

https://www.marketresearchfuture.com/reports/india-ott-market-12696

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services.

Also, we are launching “Wantstats” the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all of them most important questions.

Contact:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com